In the world of business and economics, understanding key concepts like marginal revenue can be the difference between making a profit and sustaining losses.

Whether you’re running a small business or managing a large corporation, knowing how marginal revenue works is essential for setting prices, determining output, and maximizing profits.

What is Marginal Revenue?

Marginal revenue (MR) refers to the additional revenue a company earns when it sells one more unit of a good or service.

Do not confuse this concept with total revenue. Total revenue is focused on the sum of all the revenue generated. Marginal revenue is only focused on the change in revenue from selling one more unit of a good or service.

If you’ve already read my post on marginal cost, it is the same concept but applied to revenue except cost.

How to Calculate Marginal Revenue

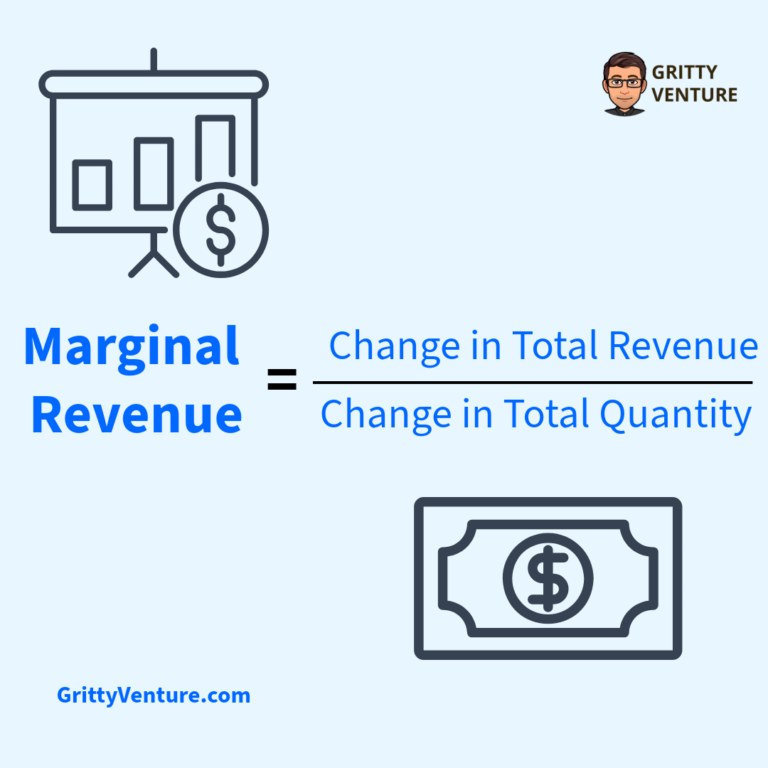

The formula for calculating marginal revenue is quite simple:

Where:

- Change in Total Revenue is the difference in overall revenue received after selling an additional unit of a good or service.

- Change in Total Quantity is the increase in the number of goods or services sold.

Let’s break this down with an example:

Imagine a bakery sells cupcakes for $3 each. If they sell 10 cupcakes, their total revenue is $30. If they sell 11 cupcakes, their total revenue is $32. The marginal revenue for the 11th cupcake is:

($32 – $30) / (11 – 10) = $2

This means that the bakery earned an additional $2 by selling the 11th cupcake.

Now, whether the bakery should produce that 11th cupcake will depend on their marginal cost, but more on that later.

Marginal Revenue Calculator

Below is a marginal revenue calculator that I have put together and is free to use. Simply include your email and it will take you to the calculation page.

Once on the calculation page you can use the calculator without needing to actually submit your email (having a 2nd page helps control the spam).

If you do submit your email you will be taken to a private page on my website where you can access and download excel files of all the calculators available today and access a link to the Private Facebook Group to continue the discussion (again, without spam!).

How Marginal Revenue Works in Different Market Structures

The behavior of marginal revenue can vary significantly depending on the market type a business operates. Let’s look at how MR behaves in different market structures:

-

Perfect Competition

In a perfectly competitive market, businesses are price takers, meaning they cannot influence the market price of their products. Here, marginal revenue equals the price of the good. Selling one more unit doesn’t affect the market price, so the additional revenue from each unit sold is the same as the price.

Example: If the price of apples is $1 each, the marginal revenue of selling one more apple is $1. -

Monopoly

In a monopolistic market, a single company dominates and can influence the price of its product. As a result, marginal revenue in a monopoly is always less than the price of the good. To sell more units, the monopolist must lower the price not just for the additional unit but also for all previous units as well.

Example: A monopoly that sells software at $100 per unit may find that in order to sell 100,000 units, they need to lower the price to $95. The marginal revenue from selling the 100,001st unit would be less than $95. -

Monopolistic Competition

Firms in monopolistic competition sell differentiated products, but they still face competition. Here, marginal revenue starts to decrease as more units are sold, but the firm still has some control over its pricing. In this structure, MR declines as output increases, though not as sharply as in a monopoly.

-

Oligopoly

An oligopoly is a market dominated by a few large firms. In this structure, marginal revenue can be influenced by the actions of competitors, leading to complex pricing strategies. Firms must carefully assess how much their competitors will produce and the prices they will set.

The Importance of Marginal Revenue in Profit Maximization

A company’s goal is to maximize profits, and marginal revenue plays a central role in this process. To do so, a business must consider the point at which marginal revenue equals marginal cost (MC).

- If MR > MC, the company can increase profit by producing more units.

- If MR < MC, the company is producing too many units and should reduce output to maximize profit.

- If MR = MC, the company is at its profit-maximizing level and should not produce any additional units.

When a firm produces the optimal quantity of goods, it ensures that it is not overspending on production costs or missing out on potential revenue. This concept is particularly important for businesses making decisions about scaling their production levels.

Marginal Revenue and Pricing Decisions

Pricing is one of the most important decisions a business will make. By analyzing marginal revenue, a firm can decide how to adjust its prices to maximize overall revenue.

Price Elasticity of Demand

Understanding how consumers respond to price changes is crucial when analyzing marginal revenue. If demand is elastic, a small decrease in price can lead to a proportionally larger increase in quantity sold, increasing total revenue. However, if demand is inelastic, a price decrease may not result in a significant increase in sales, and the firm could see its revenue drop.

Dynamic Pricing Strategies

Businesses can also use marginal revenue to develop dynamic pricing strategies. For instance, during periods of high demand, a firm might increase prices to maximize revenue, knowing that their MR will still be positive. Alternatively, in periods of low demand, they might lower prices to encourage sales without losing revenue potential.

Real-World Example: Airline Industry

One of the best real-world examples of marginal revenue I can think of is the airline industry.

Airlines often adjust their prices dynamically based on demand. If you’ve ever booked a last-minute, or short notice, flight, you know exactly where I’m going.

When a flight is nearly full, it’s not uncommon for the airline to raise the price of the remaining seats, which increases the marginal revenue for each additional seat sold.

Conversely, if a flight is not filling up as expected, they might lower prices to encourage sales, adjusting their marginal revenue accordingly.

Bringing It Home

Understanding marginal revenue is critical for businesses striving for profit maximization. By knowing how additional units sold affect revenue, companies can make informed decisions about production, pricing, and market strategy. Whether you’re in a competitive market or a monopoly, mastering the concept of marginal revenue can help your business thrive, making it a vital tool in every entrepreneur’s toolkit.